Corporate Governance

The Company's corporate governance is as follows.

Basic Policy for Corporate Governance

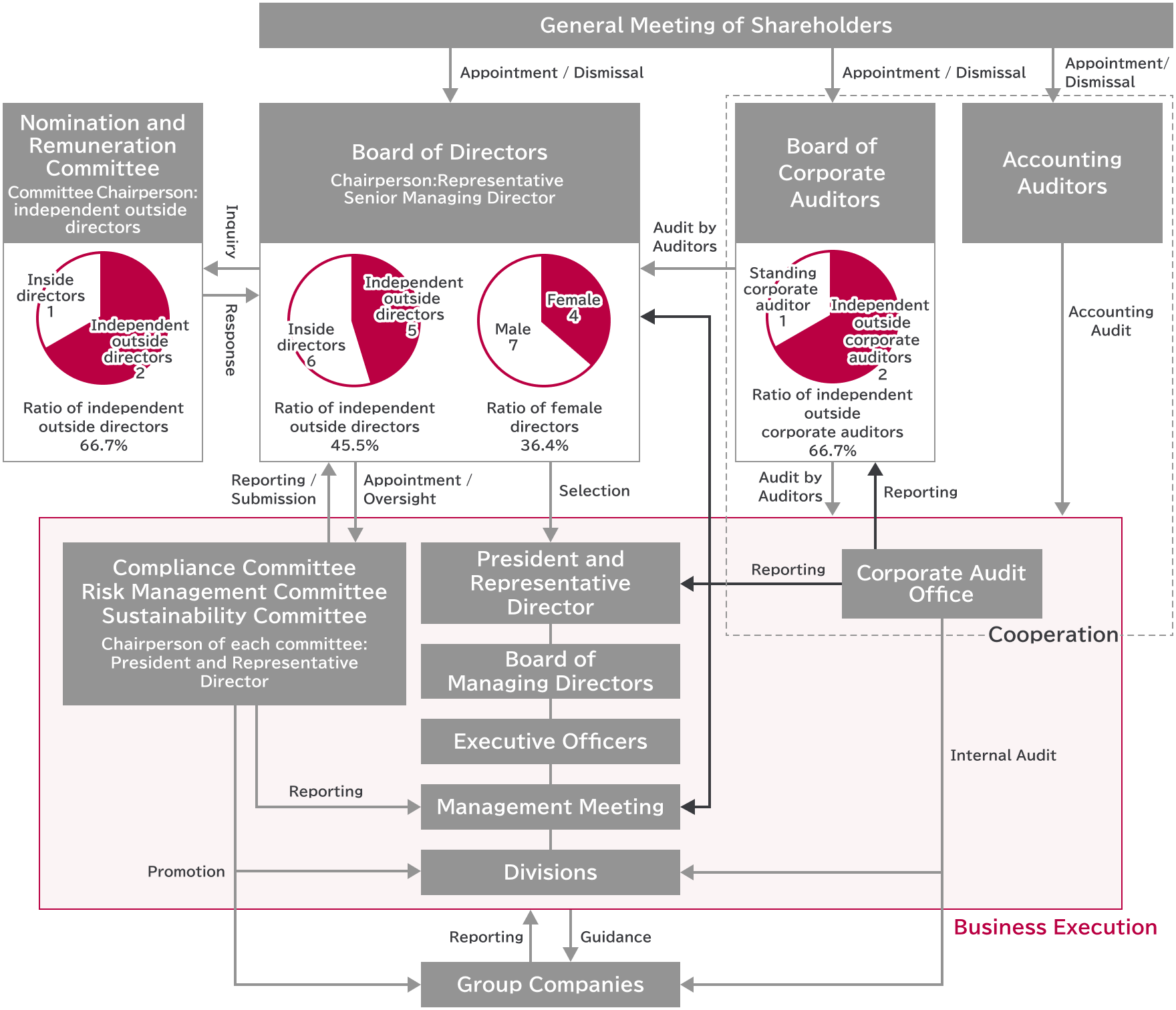

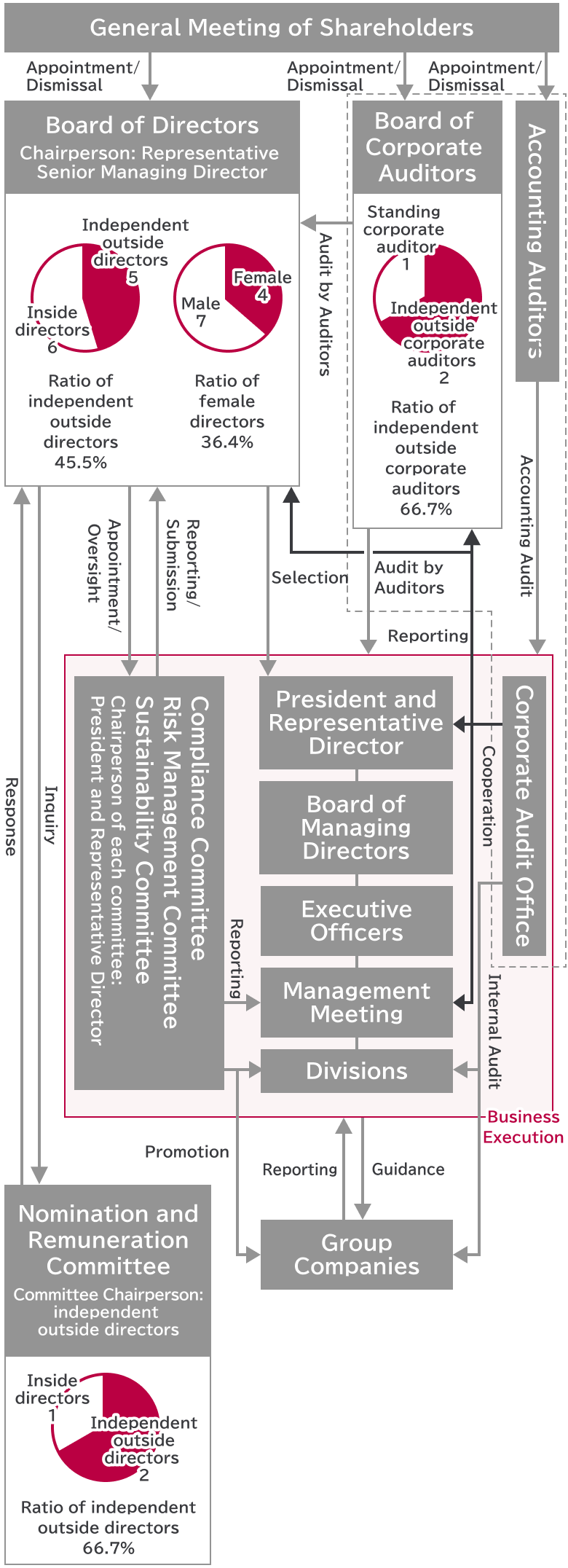

Dispensing pharmacy and retail are the key business areas being developed by the AIN Group (the Group). As this business is characterized by responsibilities for people’s health and lifestyles, we recognize it is indispensable to continue the sound and transparent business activities that prioritize compliance. To achieve this goal, we have adopted the Company with Corporate Auditors to oversee not only important decision-making in the management and the business execution, but also general corporate management.

The Corporate Audit Office which is independent from business management conducts internal audits covering all management activities related to governance processes, risk management and control, and the Group serves to ensure thorough compliance with relevant laws, internal rules and regulations. In addition to the above, as part of our efforts to enhance corporate governance, we have formed a Compliance Committee for the purpose of establishing, promoting, and embedding compliance system, a Risk Management Committee for realizing comprehensive risk management from a group-wide perspective, and a Sustainability Committee for the purpose of establishing, promoting, and embedding the Group's sustainability management system.

Outline of Corporate Governance

The Company has adopted the structure of a company with Board of Corporate Auditors, and has established the Nomination and Remuneration Committee as a voluntary advisory body. In addition, the Company separates the decision-making and supervisory functions of management from those of business execution through the introduction of an executive officer system.

In order to strengthen corporate governance, the Company has established a Compliance Committee, Risk Management Committee, and Sustainability Committee to manage and promote measures.

Board of Directors

The Board of Directors is composed of at least 1/3 independent outside directors, from the viewpoint of strengthening its supervisory function. In addition, the Company establishes skill sets for its management strategies and supervisory functions that contribute to the enhancement of corporate value over the medium to long term, and ensures that the composition of the Board of Directors takes into consideration the balance of diversity of the skills, genders, and other attributes of each officer. In order to enhance corporate value over the medium to long term, the Board of Directors formulates management policies and plans, makes decisions on the execution of important business operations, supervises and evaluates the execution of business operations by directors, and develops internal controls, risk management systems, etc., thereby contributing to ensuring the soundness of management.

The Board of Directors met 14 times for the fiscal year ended April 30, 2025, and held discussions related mainly to matters such as business strategies, compliance, risk management, status of internal audits, initiative related to materiality and the strategies of human capital management. Outside directors participate in management with appropriate advice from diverse perspectives, in addition to advice based on their respective skills when making important decisions for the Company, while also effectively exercising their supervisory functions through their high level of independence.

The attendance of each officer for the fiscal year ended April 30, 2025 is as follows.

|

Name |

Position |

Attendance |

|---|---|---|

|

Kiichi Otani |

President and Representative Director |

14/14(100%) |

|

Shoichi Shudo ◎ |

Representative Senior Managing Director |

14/14(100%) |

|

Toshihide Mizushima |

Representative Senior Managing Director |

14/14(100%) |

|

Miya Oishi |

Representative Senior Managing Director |

14/14(100%) |

|

Rieko Kimei |

Director |

14/14(100%) |

|

Nobuyuki Takakura |

Director |

14/14(100%) |

|

Noriko Endo |

Outside Director |

14/14(100%) |

|

Junro Ito |

Outside Director |

4/4(100%) |

|

Shigeru Yamazoe |

Outside Director |

4/4(100%) |

|

Hideki Kuriyama |

Outside Director |

13/14(93%) |

|

Mariko Watahiki |

Outside Director |

10/10(100%) |

|

Nobumichi Hattori |

Outside Director |

10/10(100%) |

|

Shigeki Kimura |

Outside Director |

10/10(100%) |

|

Koichi Kawamura |

Standing Corporate Auditor |

14/14(100%) |

|

Akira Ibayashi |

Outside Corporate Auditor |

4/4(100%) |

|

Osamu Muramatsu |

Outside Corporate Auditor |

4/4(100%) |

|

Ayako Sano |

Outside Corporate Auditor |

10/10(100%) |

|

Minako Mizutani |

Outside Corporate Auditor |

9/10(90%) |

Note. ◎ after the name indicates the chairperson.

At present, the Board of Directors consists of 11 members (seven men and four women), including five outside directors, and is chaired by Mr. Shoichi Shudo, Representative Senior Managing Director.

Board of Corporate Auditors

The Board of Corporate Auditors conducts audits of the execution of duties by directors, while also exchanging opinions with accounting auditors for each accounting audit, and striving to improve the accuracy of audits by corporate auditors concerning laws, regulations, the Articles of Incorporation, and matters related to accounting. In addition, the Board of Corporate Auditors accompanies audits of subsidiaries by accounting auditors, thus working to strengthen auditing functions.

Outside corporate auditors work with the standing corporate auditor to formulate audit policies and plans, inspect important documents related to management, audit financial statements and reference documents, audit proposals submitted to the General Meeting of Shareholders, check the status of the execution of business operations by directors, and provide advice, suggestions, and recommendations to directors and the Board of Directors through discussions at meetings of the Board of Corporate Auditors. In order to cooperate with the Corporate Audit Office, the Board of Corporate Auditors participates in regular internal audit meetings once a quarter and receives reports.

The Board of Corporate Auditors met 13 times for the fiscal year ended April 30, 2025, and engaged in activities mainly concerning matters such as the formulation of audit policies and plans, the preparation of audit reports, ensuring the appropriateness of accounting audits, agreement with the evaluation and remuneration of accounting auditors, and checks of the status of the development and operation of internal control systems. The Board of Corporate Auditors consult to conduct audits of the Board of Directors and the business execution to ensure that business operations are conducted with compliance in mind, and the Board of Corporate Auditors monitor, supervise, and advise on specific measures.

The attendance of each corporate auditor for the fiscal year ended April 30, 2025 is as follows.

|

Name |

Position |

Attendance |

|---|---|---|

|

Koichi Kawamura |

Standing Corporate Auditor |

13/13(100%) |

|

Akira Ibayashi |

Outside Corporate Auditor |

3/3(100%) |

|

Osamu Muramatsu |

Outside Corporate Auditor |

2/3(67%) |

|

Ayako Sano |

Outside Corporate Auditor |

10/10(100%) |

|

Minako Mizutani |

Outside Corporate Auditor |

10/10(100%) |

Furthermore, at present, the Board of Corporate Auditors consists of three members, including two outside corporate auditors, and Mr. Mamoru Oki serves as a standing corporate auditor. As the Division Manager of Internal Audit of the Company, he has experience in internal audit operations, including investigating violations of laws and internal regulations, evaluating the effectiveness of internal controls, and proposing improvement measures. Ms. Ayako Sano has wide-ranging knowledge of corporate legal affairs as an attorney at law, in addition to which she has insights into taxation. Ms. Minako Mizutani has abundant specialist experience in finance and accounting due to her experience as a tax accountant.

Nomination and Remuneration Committee

The Company has established the Nomination and Remuneration Committee as a voluntary advisory body in order to enhance the fairness, transparency, and objectivity of procedures related to the nomination, remuneration, etc., of directors and enhance corporate governance. The Board of Directors has resolved that at least half of the members of this committee will be independent officers. For the purpose of contributing to the establishment of appropriate management systems and ensuring the transparency of management, this committee mainly deliberates the appointment and dismissal of directors, succession plans, and remuneration for officers, and it expresses its views to the Board of Directors.

At present, the Nomination and Remuneration Committee consists of three directors, including two independent outside

directors. For the fiscal year ended April 30, 2025, the committee met 7 times, and deliberated director candidates, the skills matrix, succession plans, and remuneration for officers. The attendance of each committee member for the fiscal year ended April 30, 2025 is as follows.

|

Name |

Position |

Attendance |

|---|---|---|

|

Kiichi Otani |

President and Representative Director |

7/7(100%) |

|

Noriko Endo |

Outside Director |

7/7(100%) |

|

Shigeru Yamazoe |

Outside Director |

3/3(100%) |

|

Mariko Watahiki ◎ |

Outside Director |

4/4(100%) |

Note . ◎ after the name indicates the chairperson.

Furthermore, at present, the Nomination and Remuneration Committee is chaired by Ms. Mariko Watahiki, independent outside director and consists of three members including Ms. Noriko Endo, independent outside director, and Mr. Kiichi Otani, President and Representative Director.

Board of Managing Directors

The Board of Managing Directors consists of the President and Senior Managing Directors, and has been established for the purpose of deliberating and deciding on matters delegated by the Board of Directors and other important management matters in order to enhance the speed of management decision-making.

Management meetings

Management meetings consist of directors, the standing corporate auditor, executive officers, and department managers of the Group, and are held twice a month for the purpose of monitoring practical matters. Through discussions concerning the execution of business operations in each division, management meetings exercise a function of mutual checking.

Compliance Committee

The Company has established the Compliance Committee for the purpose of establishing, disseminating, and ensuring the entrenchment of the Group's compliance system, and its composition is based on a resolution by the Board of Directors.

The committee holds regular meetings once every six months, and also holds irregular meetings as needed. It deliberates and considers matters such as the Group's policies and measures related to the promotion of compliance, measures to prevent recurrence of serious compliance violations, and policies for handling individual reports, and reports and submits or submits its views to the Board of Directors. In addition, with regard to reports, from the viewpoint of protecting whistleblowers, a “compliance hotline” contact point for whistleblowers has been established by delegation to an external organization. As necessary, the committee obtains legal assessments, views, etc., from external attorneys, including when responding to reports, and engages in deliberations and consideration.

At present, the Compliance Committee is chaired by the President and Representative Director, with the Director (Division Manager of Sustainability Management) as vice chair, and three Representative Senior Managing Directors, the Director (Division Manager of Personnel), and the standing corporate auditor as members. Its secretariat is the Risk Management Office and Sustainability Management Department.

Furthermore, when deliberating and considering individual reports, depending on the content of the report, related officers and the Presidents of related Group companies, as well as other officers and employees designated by the chair or vice chair of the committee as equivalent responsible persons participate in meetings of the committee as extraordinary members.

Risk Management Committee

The Company has established the Risk Management Committee for the purpose of achieving unified risk management from a group-wide perspective and preventing the overlooking of new risk events arising from changes in the business environment, and thereby achieving comprehensive risk management. Its composition is based on a resolution by the Board of Directors. The committee holds regular meetings once every six months, and attorneys and other external experts in risks surrounding companies provide advice as appropriate. The committee mainly reviews risk items and assessments and manages progress in each department in charge of risk.

At present, the Risk Management Committee is chaired by the President and Representative Director, and it consists of the Director (Division Manager of Sustainability Management) as vice chair and managers of each department in charge of risk. Its secretariat consists of the Division Manager of the Risk Management Office and Department Manager of the Sustainability Management.

Sustainability Committee

The Company has established the Sustainability Committee for the purpose of establishing, disseminating, and ensuring the entrenchment of the Group's sustainability management system, and its composition is based on a resolution by the Board of Directors.

The committee holds regular meetings once every six months, and mainly deliberates and considers matters related to the promotion of sustainability management, and submits and reports important matters related to sustainability management to the Board of Directors.

At present, the Sustainability Committee is chaired by the President and Representative Director, with the Director (Division Manager of Sustainability Management) as vice chair, and each Division Manager, the Division Manager of the Facility Design, the Division Manager of the Corporate Audit Office, the Division Manager of the Corporate Planning, the Department Manager of the Corporate Alliances, and Presidents of key subsidiaries as members. Its secretariat is the Sustainability Management Department.

Status of internal audits

The Company has established an Corporate Audit Office that is independent of business management, in order to enhance and strengthen internal audit functions. The scope of internal audits extends to all management activities related to governance processes, risk management, and control. The Corporate Audit Office engages in activities such as drafting audit plans, conducting audit procedures for all divisions of the Group at least once a year in principle, and preparing audit reports and improvement instructions. In addition to regular audits of business operations, the Corporate Audit Office conducts personal information protection audits concerning matters such as the status of the operation of the personal information protection system.

The Corporate Audit Office cooperates with the Board of Corporate Auditors and the accounting auditors to coordinate overlapping operations and improve the quality of operations, and reports directly to the President and Representative Director, the Board of Directors, and the Board of Corporate Auditors concerning the status of activities, including the results of audits.

In addition, the Corporate Audit Office reports the status of internal audits at management meetings, and endeavors to improve compliance through individual guidance and repeats of audits in cooperation with each business division of the Group.

As of May 1, 2025, the Corporate Audit Office consisted of 14 persons.

Skill-matrix

|

Name |

Independence (for outside officers only) |

Management experience |

Finance | Legal / Compliance |

Human |

Environment |

Dispensing pharmacy business |

Retail |

|---|---|---|---|---|---|---|---|---|

|

President and Representative Director |

– | ● | ● | ● | ● | |||

|

Representative Senior Managing Director |

– | ● | ● | ● | ||||

|

Representative Senior Managing Director |

– | ● | ● | ● | ● | |||

|

Representative Senior Managing Director |

– | ● | ● | ● | ||||

|

Director |

– | ● | ● | ● | ||||

|

Director |

– | ● | ● | ● | ||||

|

Outside Director |

● | ● | ● | ● | ● | |||

|

Outside Director |

● | ● | ||||||

|

Outside Director |

● | ● | ● | |||||

|

Outside Director |

● | ● | ||||||

|

Outside Director |

● | ● | ● | ● | ● | ● | ||

|

Standing Corporate Auditor |

– | ● | ● | ● | ||||

|

Outside Corporate Auditor |

● | ● | ● | |||||

|

Outside Corporate Auditor |

● | ● |

|

Name |

Experience, etc. providing the basis for skills |

|---|---|

| President and Representative Director Kiichi Otani |

Management experience: President and Representative Director of the Company Finance: Promotes financial strategy as Representative Director Dispensing Pharmacy Business: Pharmacist; founded and has driven the expansion of the business Retail Business: Founded and has driven the expansion of the drugstore business |

|

Representative Senior Managing Director |

Management experience: Representative Director of the Company, President and Representative Director of AIN PHARMACIEZ INC. Finance: In charge of Store Development for the Company Dispensing Pharmacy Business: In charge of Dispensing Pharmacy Operations Management of the Company |

|

Representative Senior Managing Director |

Management experience: Representative Director of the Company Finance: Promotes financial strategy as person in charge of Operational Support Dispensing Pharmacy Business: In charge of Operating Management of the Company, President and Representative Director of WHOLESALE STARS Co., Ltd. Retail Business: Division Manager of Retail Operations Management of the Company |

|

Representative Senior Managing Director |

Management experience: Representative Director of the Company, President and Representative Director of AIN PHARMACIEZ INC. Dispensing Pharmacy Business: Pharmacist, Division Manager of Dispensing Pharmacy Operations Management of the Company Retail Business: President and Representative Director of AIN PHARMACIEZ INC. |

|

Director |

Management experience: Director of the Company, President and Representative Director of AYURA LABORATORIES Inc. Human capital management: as Division Manager of Personnel of the Company, leads initiatives for D&I (Diversity and Inclusion) and opportunities for women in the workplace Retail Business: Division Manager of Cosmetic and Drug Store Business of the Company and President and Representative Director of AYURA LABORATORIES Inc. |

|

Director |

Legal and compliance: Division Manager of Sustainability Management of the Company, experience in charge of Risk Management of the Company, Chief Social Responsibility Officer and person in charge of CSR at Teijin group, experience having led responses of said group’s compliance and risk management efforts from a CSR perspective Environment: Division Manager of Sustainability Management of the Company, Chief Social Responsibility Officer and person in charge of CSR at Teijin group Dispensing Pharmacy Business: Experience in promoting health and medical policies at the Ministry of Health, Labour and Welfare |

|

Outside Director |

Financial: Knowledge of international finance, fiscal policy, macro economy, and other areas as the editor of an economics magazine Legal and compliance: Research at university into risk and security governance Environment: Knowledge of energy and environmental problems obtained through research into public policy as it pertains to energy Dispensing Pharmacy Business: Knowledge gained from her involvement in reviews on social security and other such issues as a member of the government’s council related to the fiscal system |

|

Outside Director |

Human capital management: Knowledge in organizational governance and human capital management, gained through efforts to develop human resources as a manager of a professional baseball team and of the Japan national baseball team |

|

Outside Director |

Legal and compliance: Attorney at law, experience as a judge Human capital management: Possesses insights into human capital in organizational operations, gained from experience in personnel management and human resource development as President of a High Court and an instructor at the Legal Training and Research Institute of Japan. |

|

Outside Director |

Financial: Managing Director of Goldman Sachs (Japan) Ltd. (now Goldman Sachs Japan Co., Ltd.), Visiting Professor of School of International Corporate Strategy of Hitotsubashi University, Visiting Professor of Graduate School of Business and Finance of Waseda University, Guest Professor of Graduate School of Business Administration of Keio University |

|

Outside Director |

Management experience: Representative Director of Seven & i Holdings Co., Ltd., Director of Seven-Eleven Japan Co., Ltd. Financial: Division Manager of Financial Accounting and Division Manager of Management of Seven-Eleven Japan Co., Ltd. Legal and compliance: Division Manager of Management of Seven-Eleven Japan Co., Ltd. Human capital management: Division Manager of the Corporate Personnel Planning of Seven & i Holdings Co., Ltd. Retail Business: Representative Director of Seven & i Holdings Co., Ltd., Director of Seven-Eleven Japan Co., Ltd. |

|

Standing Corporate Auditor |

Legal and compliance: Experience as Division Manager of Internal Audit of the Company Dispensing Pharmacy Business: Pharmacist, experience in store operations within the Dispensing Pharmacy Business Retail Business: Experience in store operations within the Retail Business |

|

Outside Corporate Auditor |

Financial: Was employed by Goldman Sachs (Japan) Ltd. (now Goldman Sachs Japan Co., Ltd.) Legal and compliance: Attorney at law, outside corporate auditor of another company, auditor of incorporated administrative agency |

|

Outside Corporate Auditor |

Financial: Tax accountant |

Details of skills and reasons for selection

With regard to the skill sets required by the Board of Directors, the Company’s management strategy is business growth centered on both the dispensing pharmacy business and the retail business, and the Board of Directors considers and selects the skills required to develop supervisory functions that contribute to the enhancement of corporate value over the medium to long term, after deliberation by the Nomination and Remuneration Committee.

|

Necessary skills |

Details of skill |

Reason for selection |

|---|---|---|

|

Management experience |

Has management experience in a listed |

Necessary for building appropriate |

|

Finance |

Holds certified public accountant or tax |

Necessary for achieving sound management |

|

Legal affair and compliance |

Holds attorney at law qualifications, or has |

Because a proper awareness and |

|

Human capital management |

Has operational and management |

The greatest source of business growth is |

|

Environment |

Has operational and management |

Necessary for the promotion of |

|

Dispensing Pharmacy Business |

Knowledge and experience of the |

As the importance of understanding various |

|

Retail Business |

Knowledge and experience of the Retail |

Necessary for achieving a bird’s eye view |

Independence Criteria for outside directors and outside corporate auditors

The company determines “Independence Criteria for outside directors and outside corporate auditors” and “Immaterial Criteria for the judgement that the relationship with the Company is unlikely to affect shareholder’s decision concerning the exercise of voting rights” in order to judge their independence objectively.

Independence Criteria for outside directors and outside corporate auditors

An outside director and/or an outside corporate auditor of the Company (hereinafter referred to as the “outside officer”) will be determined as sufficiently independent from the Company if the said outside officer satisfies the requirements set forth below:

1. Presently or at any time within the past ten years, the person has never been an executing person of the Company or a consolidated subsidiary (hereinafter referred to as the “AIN Group.”)

2. Presently or at any time within the past five years, the person has not fallen under any of the following items:

(1) A person who directly or indirectly holds 10% or more of voting rights of the Company, or its executing person;

(2) A person of a company of which the AIN Group holds directly or indirectly 10% or more of the total voting rights, or its executing person;

(3) A counterparty which has transactions principally with the AIN Group (total amount of transactions with the AIN Group exceeding 2% of annual consolidated sales of the party), or its executing person;

(4) A principal counterparty of the AIN Group (total amount of transactions with the party exceeding 2% of annual consolidated sales of the AIN Group), or its executing person;

(5) A consultant, accounting professional or legal professional who has been paid by the AIN Group a large amount of money exceeding the greater of 10 million yen or 2% of the gross income of the person or other assets in addition to the remuneration for directors. (in the event that the consultant, accounting professional or legal professional is an organization such as an artificial person or association, a person who belongs to such organization is included);

(6) A person/organization who receives a donation of a large amount of money exceeding the greater of 10 million yen or 30% of the gross expense of the person/organization from the AIN Group, or an executive person;

(7) A person who is a major lender of the AIN Group (total amount of borrowings from the person exceeding 2% of total consolidated assets of the AIN Group), or its executing person;

(8) A person who belongs to auditing firm, which is an accounting auditor of the Company;

(9) An executing person in other company of which the executing person of the Company is an outside officer of the other company

3. If an executing person of the Company or a person listed Clause 2 of this criteria is correspond to an important person (director except outside director, corporate auditor except outside corporate auditor, executive officer, department manager and higher management grades), a person is not a spouse of, relative within the second degree of relationship with said person.

Formulated November 28, 2023

Immaterial Criteria for the judgement that the relationship with the Company is unlikely to affect shareholder’s decision concerning the exercise of voting rights

In the event that an outside director or an outside corporate auditor of the Company (hereinafter referred to as the “outside officer”) satisfies the requirements set forth below, the Company judges that the attribute information of the outside officer is unlikely to affect shareholder’s decision concerning the exercise of voting rights:

1. A counterparty with the total amount of transactions with the AIN Group not exceeding 1% of the annual consolidated sales of the AIN Group nor the sales of the party in the previous fiscal years, or its executing person.

2. A person that has received a donation not exceeding 10 million yen from the AIN Group in the previous fiscal years, or its executing person.

Formulated November 28, 2023

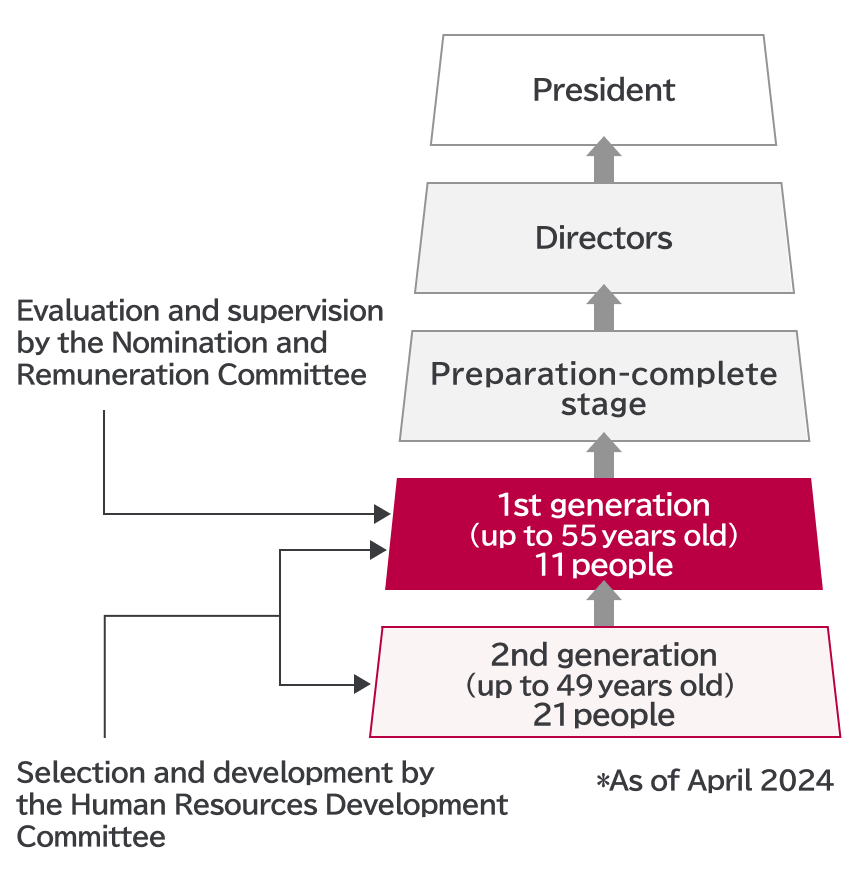

Succession Plan

The Nomination and Remuneration Committee engages in discussions regarding the required character of the next president. The Human Resources Development Committee (President, Representative director, Officer in charge of personnel ) then selects candidates and formulates and implements development plans. The Nomination and Remuneration Committee supervises and evaluates the status of the candidate development. Currently, we are evaluating, shortlisting and replacing successor candidates.

Succession plan steps

- Planning of roadmap

- Formulation of the image of the ideal president and evaluation criteria

- Selection of successor candidates

- Formulation and implementation of development plan

- Evaluation, shortlisting and replacement of successor candidates

- Evaluation of shortlisted candidates and nomination of candidate

- Support after nomination

Development of candidates

Regarding the ideal personality required for the next president, we focus on improving business value over the medium to long term, and need to have business management skills and experience, deep knowledge of finance, as well as a sincere personality. We have selected several candidates and aim to develop them by having them gain specific experience through company management and business operations as directors and executive officers, including at Group companies.

Evaluation of candidates

In addition to evaluation based on the requirements for the next president, candidates are interviewed by outside directors who serve on the Nomination and Remuneration Committee to gain an understanding of their personalities. Under deliberations by the Human Resources Development Committee, as necessary, requirements and processes are reviewed and candidates are replaced. The final candidates are reported to the Board of Directors after deliberation by the Nomination and Remuneration Committee.